Understanding Ledger Reconciliation

- Ledger reconciliation is an essential process in accounting that involves matching and verifying transactions recorded in your general ledger with external documents like bank statements and invoices.

- This ensures the accuracy and completeness of your accounting records, allowing businesses to maintain transparency and financial integrity.

Steps to Reconcile a Ledger

Follow these steps to efficiently reconcile your ledger:

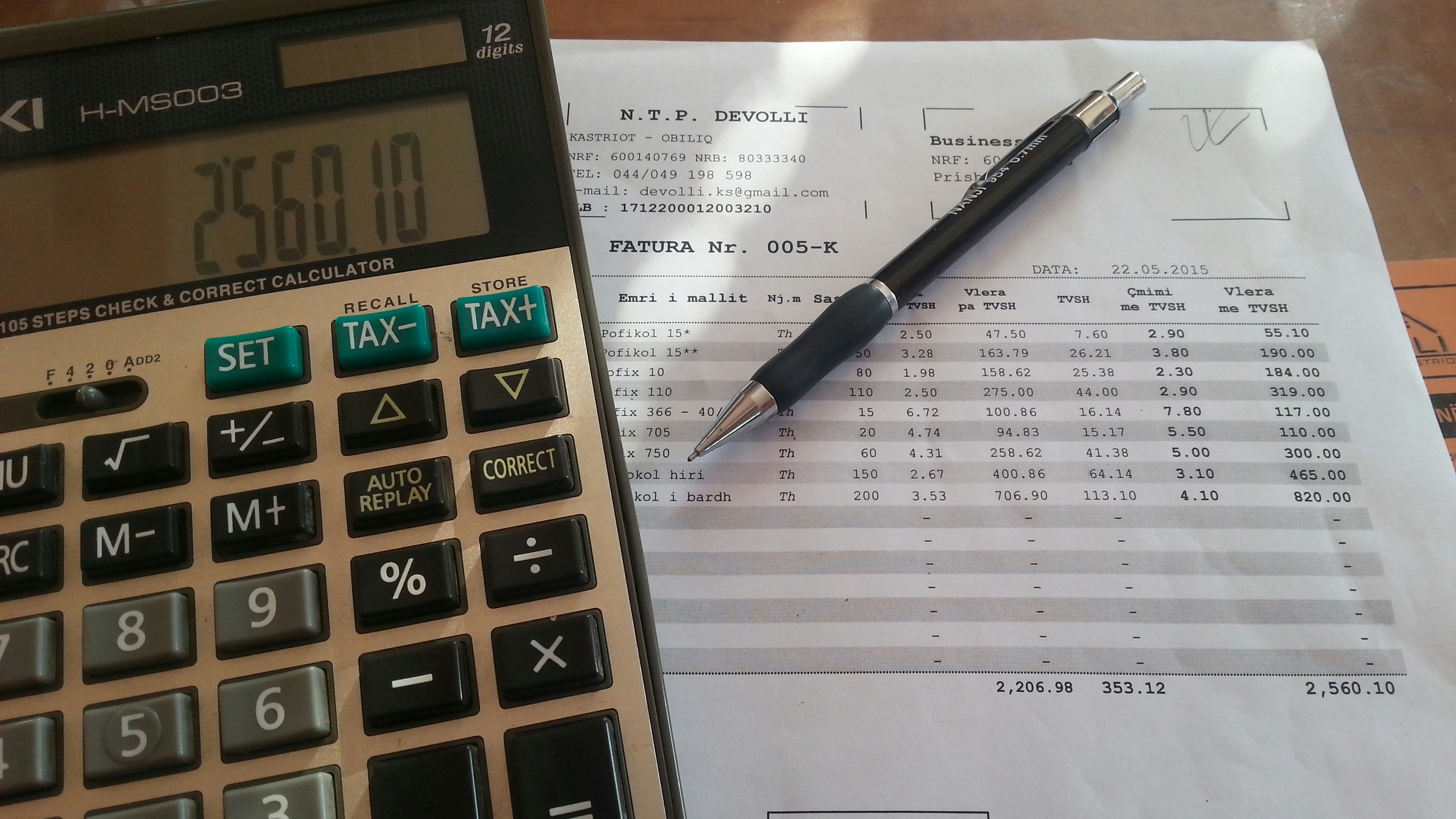

- Gather Necessary Documents: Collect your general ledger for the period, relevant sub-ledgers (like accounts payable/receivable), bank statements, invoices, receipts, and the trial balance.

- Identify the Account to Reconcile: Choose the specific account that needs reconciliation, such as the bank account, accounts receivable, accounts payable, inventory, or fixed assets.

- Match Transactions: Compare the ledger entries with the supporting documents. In the case of bank reconciliation, this includes matching deposits, withdrawals, and any charges. Create a reconciliation sheet using Excel or accounting software, including columns for dates, particulars, ledger amounts, actual amounts, differences, and notes.

- Investigate Discrepancies: If mismatches arise, check for errors in data entry, unrecorded transactions, or timing differences. Ensure there are no duplicate entries to maintain accuracy.

- Make Adjusting Entries: After identifying discrepancies, pass journal entries to correct missed entries, accruals, prepayments, or any errors noted. For example, if bank charges were neglected, record this with appropriate debits and credits.

- Final Check: Ensure the ending balance matches the external documents, and add comments to explain significant adjustments. It’s crucial to have the reconciliation reviewed and approved by a supervisor if you’re in an organizational setting.

Tips for Smooth Ledger Reconciliation

To enhance your reconciliation process, consider reconciling monthly or more frequently. Utilize accounting software such as Tally, Zoho Books, QuickBooks, or SAP for efficiency. Maintaining a checklist for each account and keeping supporting documents organized can further streamline this essential task.